Dai

$DAI

8 Results

WHAT HAPPENS WHEN BONDS HAVE A HIGH EMISSIONS SCHEDULE Traditional markets have undeniably faced a whirlwind of volatility over the past week. The bond market continued its recent trajectory with the long end of the yield curve soaring to new multi-decade highs. At one juncture, the 30-year yield even brushed against the 5% mark, a development that has rattled both bond and equity investors. Concurrently, the DXY index maintained its...

DOVISH FED STATEMENT On Wednesday, the Federal Reserve raised the target Fed Funds rate range by 25 basis points (BPS), marking the ninth increase in just over a year. The FOMC statement hinted at a nearing end to rate hikes by removing the reference to "ongoing increases." According to the FOMC's updated forecast, there will be one more rate increase this year, and officials expect slower economic growth in 2023...

DESPITE MARKET PULLBACK, JACKSON HOLE WAS NOTHING OF SUBSTANCE Fed Chair Jerome Powell took to the microphone on Friday afternoon for the first time since he announced the Fed’s prior 75 bps rate increase. Powell has mastered the art of tactful political speech, as he used 10 minutes of words to say nothing of substance. While there was a small corner of the market that thought Powell would cavalierly announce...

FIGURE: GHO LAUNCHING AMIDST THE BLOWUPS AROUND IT Seeing the CeFi realm blowing up around us, it is perhaps pertinent to reflect and hammer the lessons into our collective crypto consciousness. Drawing from CeFi, DeFi and Everything in Between, it is clear now that Celsius, BlockFi, and Voyager Digital function as ‘CeDeFi,’ similarly to TradFi banking entities and are prone to the same weaknesses such as position opacity and human...

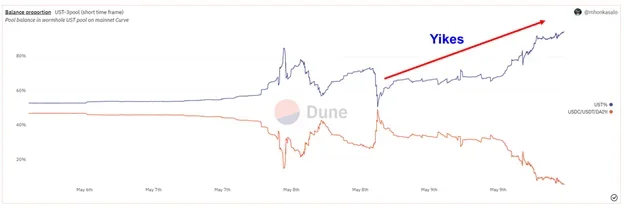

THE MAKINGS OF A QUASI-BANK RUN As if investors needed more reasons to be bearish, the market was thrown into a slight bout of chaos on Monday after a quasi-bank run on UST. Please refer to our prior work on the topic for further background information on UST’s functionality, Luna Foundation Guard, Anchor, and stablecoins. FIRST PEG-BREAK We have ample reason to believe that the “run” on UST was not...

FIGURE: FARMER PEPE REKT BY DE-PEGGED ALGO STABLES In the last issue of DeFi Digest, we discussed the need for stablecoins to have utility to maintain their pegs, before diving deep into the different kinds of stables. Now that we have a lay of the (stables) land, we extract essential lessons from stable projects which have come and gone before us. Then, we take a step back to examine the...

Figure: Pepe Meditating to Peg the Universe of DeFi Stablecoins FINDING STABILITY FIGURE: MARKET CAPITALIZATION OF PROMINENT STABLECOINSSource: CoinMetrics. io Stablecoins (‘stables’) are cryptocurrencies that aim to peg their prices to another cryptocurrency, fiat money, or commodities. For the stables primer below, we specifically refer to stablecoins pegged to currencies, the most widely adopted of which is the U.S. Dollar. Many stablecoin projects try to maintain the peg to their...