TerraUSD (Wormhole)

$UST

14 Results

FIGURE: GHO LAUNCHING AMIDST THE BLOWUPS AROUND IT Seeing the CeFi realm blowing up around us, it is perhaps pertinent to reflect and hammer the lessons into our collective crypto consciousness. Drawing from CeFi, DeFi and Everything in Between, it is clear now that Celsius, BlockFi, and Voyager Digital function as ‘CeDeFi,’ similarly to TradFi banking entities and are prone to the same weaknesses such as position opacity and human...

UPDATE ON THE MERGE Despite one of our potential catalysts for the year being struck down this week (the GBTC conversion to spot ETF), the prospects for a 2022 Ethereum remain intact. This weekend, ETH developers will attempt the second of three testnet merges on the path to mainnet Merge. Testnet merges are essentially dress rehearsals for the main event – the Merge of the Ethereum mainnet. The first testnet...

FIGURE: 3AC’S CONTAGION AFFECTING CEFI, DEFI, AND CEDEFI Over the past two weeks, we have seen the bear markets bringing out the worst in digital asset markets. Rumors of insolvency flew rampant in the face of volatility, affecting behemoths that were previously deemed ‘too sophisticated/large to fail.’ Celsius, which we covered in detail in The Tide Pulling Out, was one of the first to waver, fueling fears of contagion in...

THE BLOODBATH The bloodbath that has persisted for the better part of the past seven months continued this weekend, with the market shedding an additional $200 billion in total market cap, falling below the $1 trillion mark for the first time since late 2020. Yesterday was the single biggest decline for bitcoin (-16%) since March 2020. At the time of writing (early morning hours of June 14th), there have been...

FIGURE: GCR, GALOIS CAPITAL, 0XHAMZ, FREDDIE RAYNOLDS & CO. EMERGING VICTORIOUS AGAINST TERRA Source: Fundstrat CLOSING THOUGHTS ON TERRA Earlier readers of DeFi Digest will remember our initial primer on Anchor Protocol and the update we published when Anchor introduced the Dynamic Earn Rate. While we attempted to quantify the runway LFG had before they needed to replenish the Yield Reserve, LUNA -9.16% ’s sudden death spiral was difficult to predict. Instead,...

THE QUESTION REMAINS – WEN[1] BOTTOM? Since the November highs, most of the downward pressure on crypto prices has been the product of macroeconomic headwinds. Inflation has yet to conclusively rollover, and the Fed appears intent on stifling demand to bring down the costs of consumer goods. Last week, we had the first instance this year of an idiosyncratic event specific to the crypto markets shaking investors and sending prices...

Crypto Chat: Terra's UST stablecoin unraveled last week and the entire crypto market was shaken up, now what?

Last week Terra’s UST (UST) took a drastic plunge, losing its dollar peg, shaking up the crypto market, and the incident exposed the weakness of algorithmic stablecoins. Walter Teng & Carrie Presley discuss the Terra Luna (LUNA -9.16% ) ecosystem, including recent developments from Do Kwon, co-founder of Terra Luna blockchain. CRYPTO WEEKLY: THE UST UNWIND AND ITS IMPLICATIONS CRYPTO MARKET UPDATE FROM SEAN FARRELL

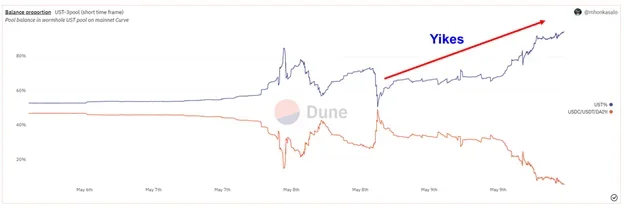

THE MAKINGS OF A QUASI-BANK RUN As if investors needed more reasons to be bearish, the market was thrown into a slight bout of chaos on Monday after a quasi-bank run on UST. Please refer to our prior work on the topic for further background information on UST’s functionality, Luna Foundation Guard, Anchor, and stablecoins. FIRST PEG-BREAK We have ample reason to believe that the “run” on UST was not...

Figure: Pepe Meditating to Peg the Universe of DeFi Stablecoins FINDING STABILITY FIGURE: MARKET CAPITALIZATION OF PROMINENT STABLECOINSSource: CoinMetrics. io Stablecoins (‘stables’) are cryptocurrencies that aim to peg their prices to another cryptocurrency, fiat money, or commodities. For the stables primer below, we specifically refer to stablecoins pegged to currencies, the most widely adopted of which is the U.S. Dollar. Many stablecoin projects try to maintain the peg to their...

WEEKLY RECAP It was another week of green candles across the crypto ecosystem as bitcoin flirted with its 200-day moving average for the first time in several months. Like last week, the more speculative sectors outperformed the prior 7-days, with the once-beleaguered DeFi sector continuing to turn some heads. _Source: Messari_ Below we examine some of the reasons we think that this relief rally mirrors those seen in late 2021...

Walter Teng, Digital Asset Strategy Associate, recently reported an overview of the Anchor Protocol (ANC -1.48% ) in our DeFi Digest publication, noting a 19.5% earn rate. Walter provides a brief overview of the protocol and what’s shifted in the last few days. (UST) DEFI DIGEST: ANCHOR PROTOCOL

WEEKLY RECAP The global crypto market continues to exhibit a range-bound choppiness, waxing and waning on the latest headlines. We saw ETH -1.28% and BTC -2.55% start the week above the $43k level after benefitting immensely from Russian sanctions and the narratives surrounding them. Since then, markets have retreated as commodity prices skyrocket – oil hit $130 per barrel, wheat prices reached a 14-year high, and a metal exchange had to roll...