Part 2

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

“I and others were mistaken early on in saying that the subprime crisis would be contained. The causal relationship between the housing problem and the broad financial system was very complex and difficult to predict.”— Ben Bernanke

“Bonds lead stocks. That’s key because we think stocks follow bonds, or bonds lead stocks.” – Tom Lee

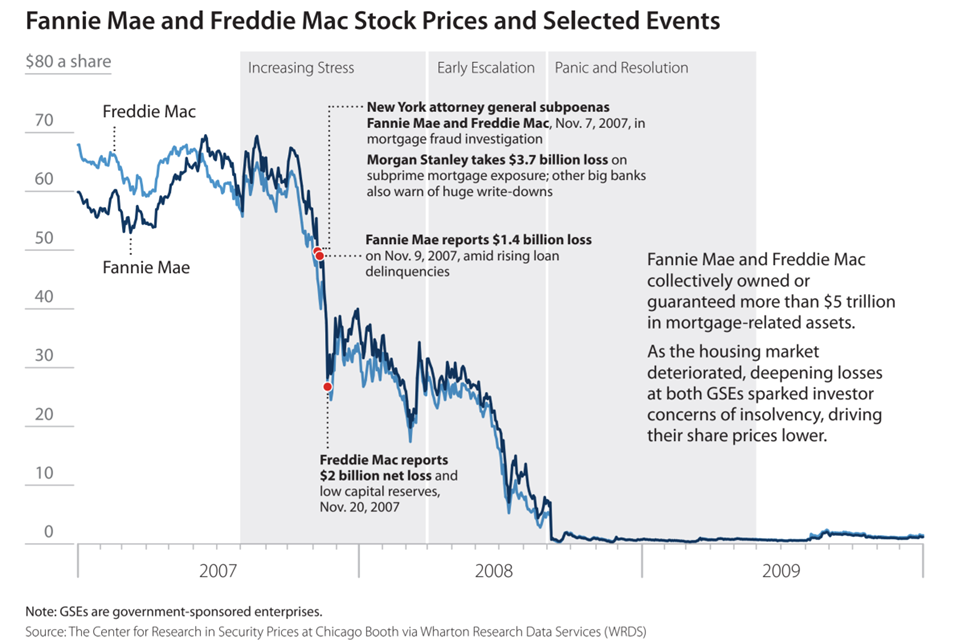

Many intelligent people were initially dismissive of deteriorating conditions in the mortgage market. Housing had always been a sturdy source of demand in the U.S., and there was nothing in the historical data driving many models to suggest what happened was even possible. Few people understood just how catastrophic relatively new types of asset-backed securities and derivatives could be to a company’s balance sheet, until they saw the devastation for themselves.

Daily Technical Strategy covering all major trends!  Technical Strategy Daily

Video and Research Publications! |

The complex interplays between housing prices, the availability and types of mortgages and the exponential rise in strategic defaults as foreclosures rose was difficult to forecast or anticipate. A few well-laureled folks did anticipate it and made off handsomely, but there’s already a movie about that.

While the people who bet against the mortgage market received the publicity, the problem was that virtually all of the banking industry had bet in the other direction. It also didn’t help that sometimes derivatives positions that proved very problematic were used to reduce regulatory capital when they increased risk. Rating agencies failed in their core function.

The shocking events that transpired toward the end of the first decade of the new millennium resulted in the greatest financial collapse since the Great Depression. The global economy was threatened since one of the major sources of demand that was at the root of the problem was from a savings glut held by foreign investors searching for yield[MG1]. Investors, and models largely operated on the assumption that mortgage securities were as safe as U.S. government debt, which was clearly not true. One of the lessons crystallized by the extraordinary events was that if problems occur up the chain in the capital structure from equity, even seemingly invincible companies can be smashed to dust.

However, even in 2009, the speed of the decline was symmetric to the speed of the recovery as our graphic above showed. Even the turmoil around COVID was less of a drop than what happened following the collapse of Lehman Brothers. Markets got cut in half and there was great reason to fear far worse outcomes than ended up transpiring. It likely would have been a lot worse if it weren’t for government assistance directly to distressed and undercapitalized banks.

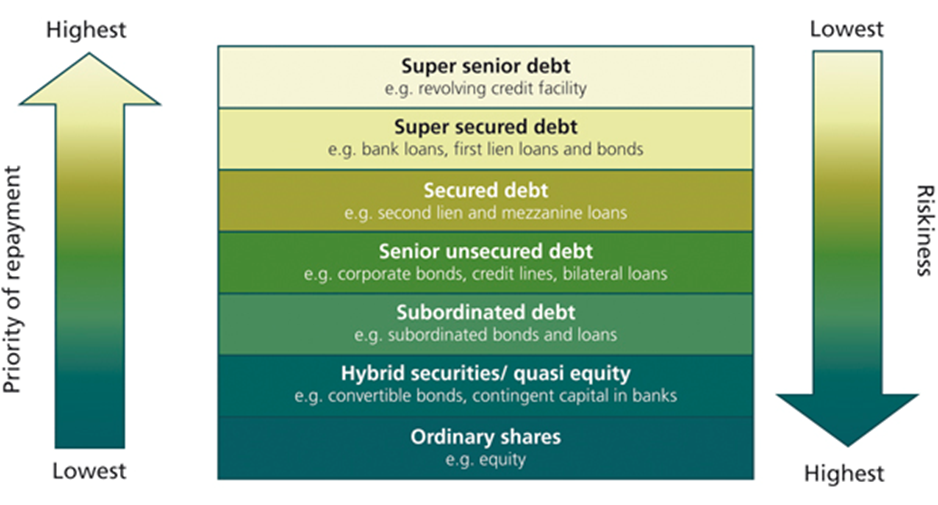

What is the bane of all shareholders? Bankruptcy, of course. Owning equity in a company is junior in the capital structure because it has the lowest repayment priority in the event of insolvency. If you own a company’s bonds, then you have a higher likelihood of getting paid back in the event of bankruptcy than if you own their equity.

So, when the entire banking system loaded up on illiquid asset-backed securities and derivatives backed by very shaky mortgage assets and you have bankruptcies on the scale of Lehman Brothers and hundreds of bank failures, the outlook was bad for shareholders. Believe it or not, forced liquidation no matter what the cause is often worse on prices than wars, famines and even pandemics.

Interested in investing with ETFs?  FSI Sector Allocation Rebalanced Monthly

|

When times are good and prospects for growth are improving you are happy owning a company’s equity. However, if a company is having trouble paying back its debts in any fashion, then it is decidedly a very bad thing for the equity shareholders. If there isn’t enough for the company’s creditors, then there definitely isn’t enough for those who own the equity and most often a company will not make it out of this situation without the protection afforded by bankruptcy to restructure.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World