Part 5

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

“Whenever we’re looking at something and how it affects markets, it’s not necessarily how fundamentals will change. It’s the confidence about those fundamentals. That’s why sometimes you see the market go a little crazy.” -Tom Lee

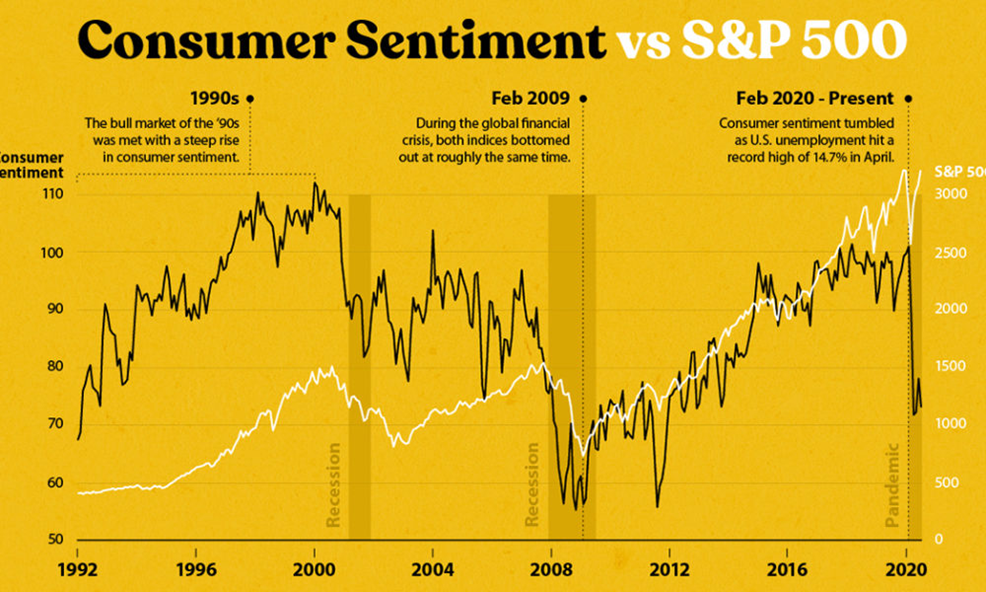

The stock market and consumer sentiment usually rise and fall in tandem. As consumers and investors become more optimistic about the state of the economy and their personal financial circumstances, stocks tend to rise. Similarly, when they become less confident about the economy, stocks usually fall. It’s often that simple, especially in the short run. Confidence detects market direction.

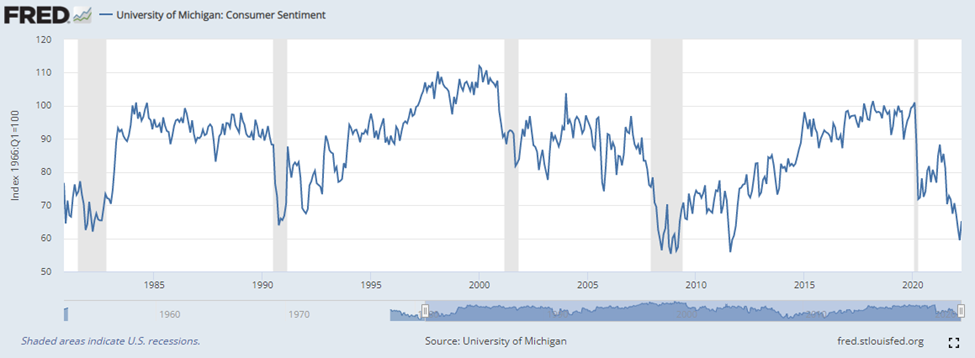

When consumers are confident in the future, they spend money and drive economic growth higher. When they aren’t confident, they save more than they spend, which restricts economic growth. Consumer confidence indices can be used as leading indicators for a broad economic turnaround. It can also be used to gauge the effectiveness of monetary policy, stimulus, or other measures. The University of Michigan Consumer Index is one of the chief sources investors often use to assess the consumer’s temperature.

As you can see, drops in consumer confidence have been a key feature of recessions (highlighted in grey) over the past 40 years. At its core, consumer confidence is particularly important in that consumer spending is arguably the most vital component of the economy. There are other important measures of consumer confidence as well. The Consumer Confidence Index (CCI), and the Consumer Sentiment Index, are both based on a household survey and reported monthly. The CCI is one of the more accurate and closely watched economic indicators, based on a survey of five questions posed to 5,000 households, measuring their optimism on the economy’s health. But it’s widely viewed as a lagging indicator that tells us what has happened – not what will happen.

What result does increasing consumer confidence have on markets? Manufacturers increase production. Banks extend more credit. Real estate markets usually benefit from an increase in home sales.

What determines consumer confidence? The state of the economy, headlines, changes in house prices, unemployment rates, and inflation all factor. Falling home prices, for example, erode consumer confidence. Increased unemployment rates also negatively affect consumers’ confidence. Inflation is an indicator of too much growth, and the rise in prices can reduce consumers’ purchasing power and confidence.

In 2020 and 2021, investor confidence soared as the Federal Reserve stepped in with economic stimulus. Combined with the re-opening of the economy following the COVID-19 shutdowns, consumers grew increasingly optimistic, and the stock market posted strong returns in both 2020 and 2021. In the spring of 2022, however, sentiment dropped sharply, mostly on concern of the Federal Reserve’s desire to increase interest rates to curb inflation, as well as the Ukraine war.

But generally, the loss of confidence isn’t necessarily an ominous sign for stocks. When confidence in the market drops sharply over three months, the S&P 500 rises more than 20% over the next year. Thus, negative sentiment is often a reliable contrarian signal over time. This worked inversely last fall when markets hit all-time highs. Just as sentiment and confidence had soared, it was time to become less optimistic on markets. Conversely, when sentiment reaches abysmal historical lows, it might be a sign that brighter days for markets are ahead. Of course, these are just some of many indicators that must be used successfully with other vital pieces of data.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World