Part 7

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World

Breaking rocks in the hot sun, you fought the Fed and the Fed won. Why does the Fed have a bazooka and why are they taking away a punch bowl? Why are investors never supposed to directionally challenge what the Federal Reserve is doing? Because the Federal Reserve is the most powerful entity in the financial world due to its outsized power in controlling liquidity. If the market was a farm, the Fed basically controls the water supply. It controls the Federal Funds rate which then in turn influences the rates that have consequence for the real economy. You can see the effects of recent tightening by the Federal Reserve in mortgage markets. The hikes of the Federal Funds rate have already began filtering to the real economy. Activity and demand are cooled by the higher debt service payments that reverberate throughout the economy.

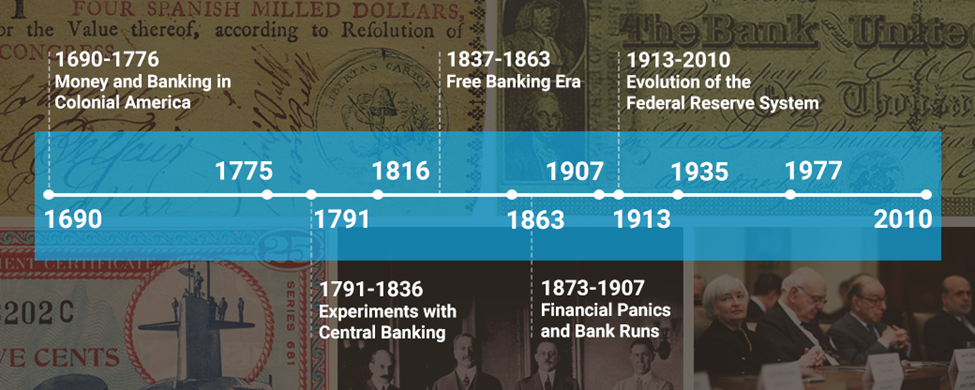

The Federal Reserve is America’s central bank. It was founded by an act of Congress in 1913 after a period of persistently occurring financial crises that shook the stability of markets. Bank runs were a common occurrence in the late 19th and early 20th centuries. There was no designated lender of last resort which obviously tends to make the troughs of financial crises much lower than they otherwise would be. If there’s no one to provide liquidity at a trough, it has a higher likelihood of becoming a depression. The “inelastic nature” of the currency during financial crises made them worse and prolonged them. In a nutshell, two of the major goals of the establishment of the Federal Reserve was to always have a lender of last resort and to make the money supply more responsive and elastic.

The Dual Mandate

The Fed is independent from the rest of the Federal Government. For example, funding for the important Central Bank happens outside the normal discretionary budget process. The Fed is also supposed to be independent from the whims of politician. Given its importance in economic matters, crafters of the Federal Reserve Act thought it best to try to insulate the important body from political machinations.

The Fed also has two main mandates and a more recent one that has only been codified in statute since the Dodd-Frank Act. We’ll take you through what the goals of the mandates are and some recent changes to the price stability mandate.

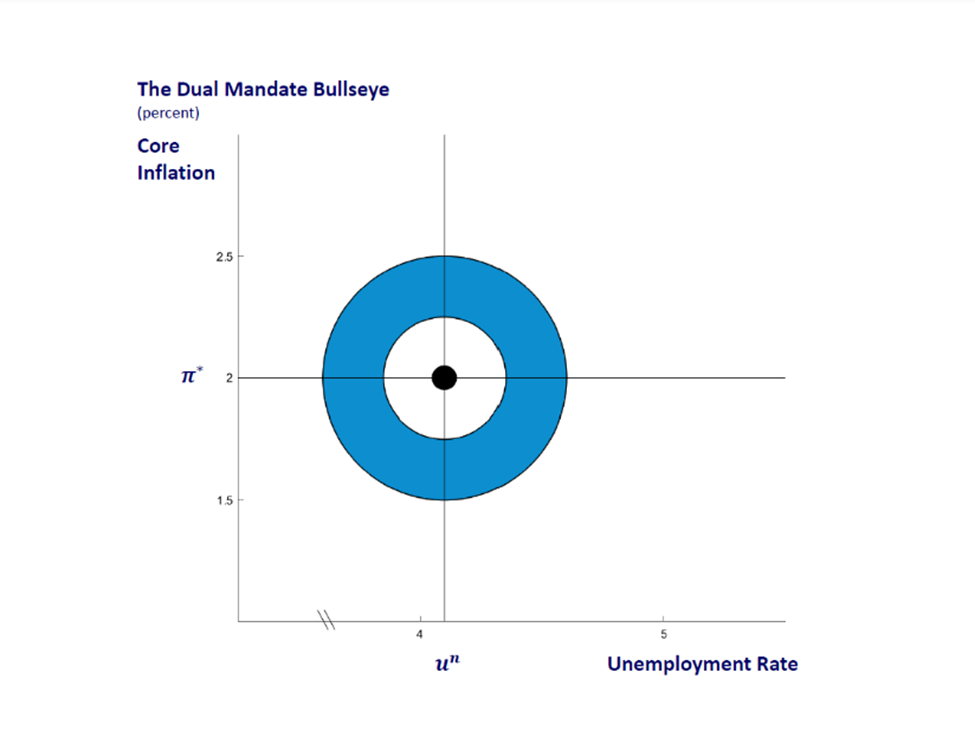

Price Stability: The Fed’s price stability mandate is one leg of the dual mandate. The committee has set a target of 2% inflation that it attempts to target, along with certain levels of the unemployment rate. As you can see, there is some latitude. There is even more since the Fed announced its Alternative Inflation Targeting (AIT) framework which allowed the committee more flexibility in inflation running above 2% with the idea it can be corrected later to still maintain average levels near the target. The idea is to not let inflation run above or below the target very much for very long. The Fed is now currently undergoing a tightening cycle because inflation has run at 40-year highs.

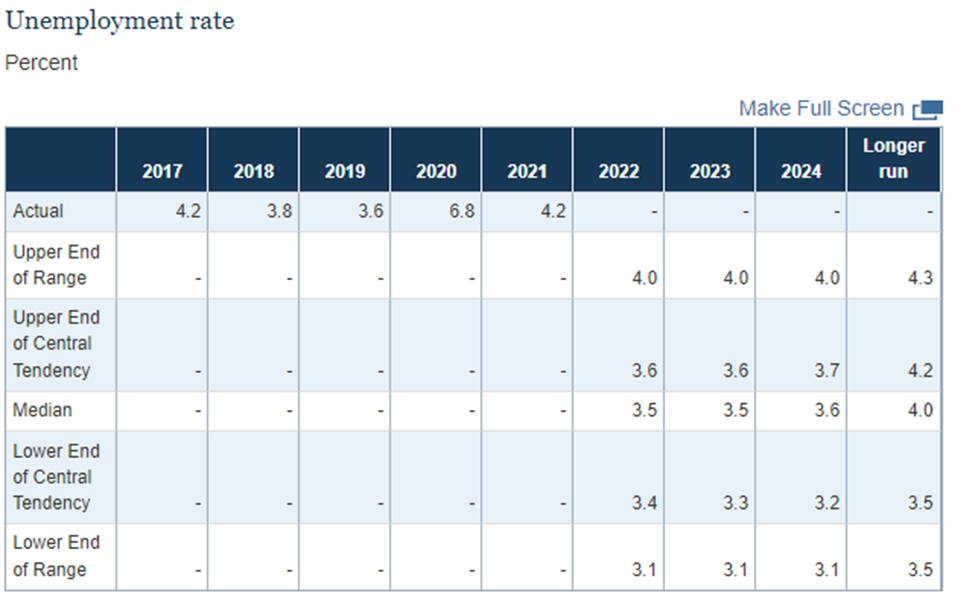

Maximum Sustainable Employment: Monetary supply is a blunt tool that is fraught with the risk of policy error. Managing the employment rate can be even harder if the circumstances are difficult. There are plenty of non-monetary and idiosyncratic factors that affect levels of employment and the labor market. COVID-19 and its uneven effect throughout different kind of industries is a prime example of this. So, unlike the inflation target, there is not a direct or specific target like 2% for inflation. Rather there are more nebulous goals that regularly change in the Summary of Economic Projections which is pictured below from the March 2022 meeting.

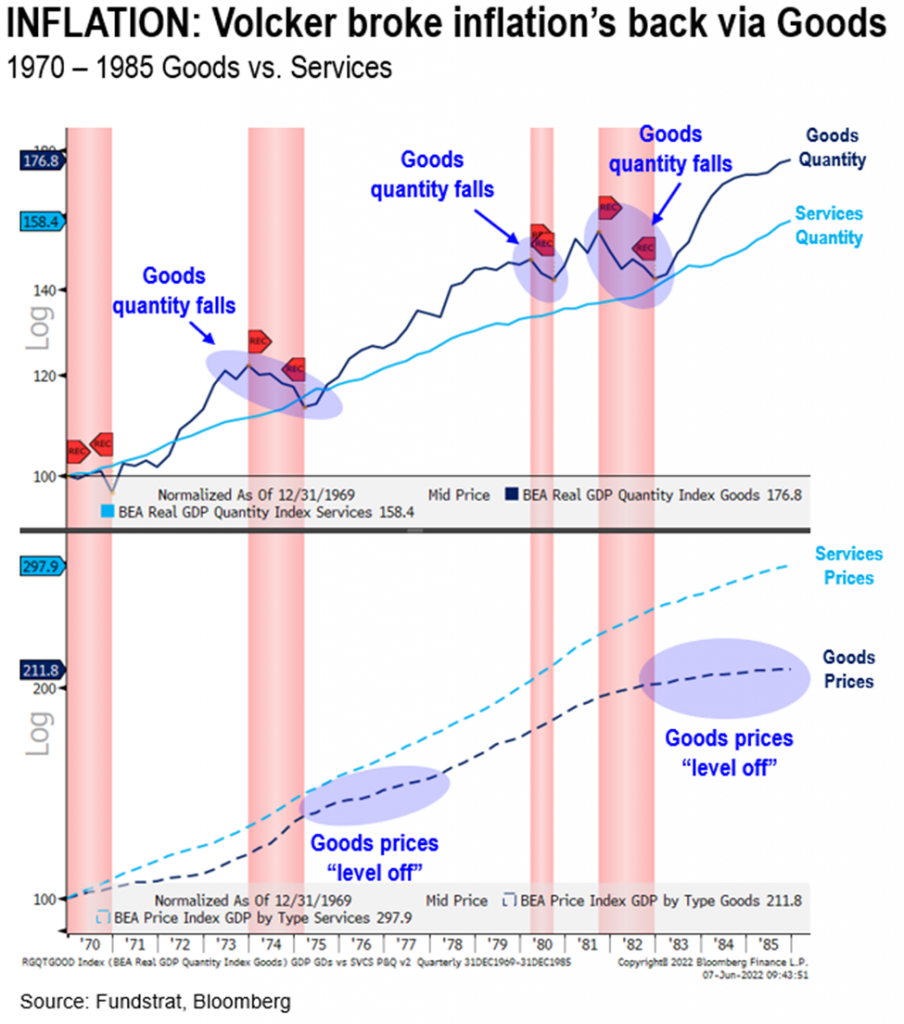

The rule of not fighting the Fed is not always as simply “since the Fed is tight, I won’t touch equities.” There are second and third order effects at play about the Fed and understanding the psychology of the FOMC itself can sometimes be useful. The Fed has a difficult task and they projected inflation terrible in the aftermath of COVID-19. Thus, sometimes at least, they may be talking tough to re-establish credibility in the eyes of the market. It’s also important to pay attention to the history of the Federal Reserve and what was successful policy in the past. For example, Chairman Volcker broke the back of inflation by conducting massive hikes that are unimaginable today. The thing that eventually broke the back of inflation was goods, services continued to rise.

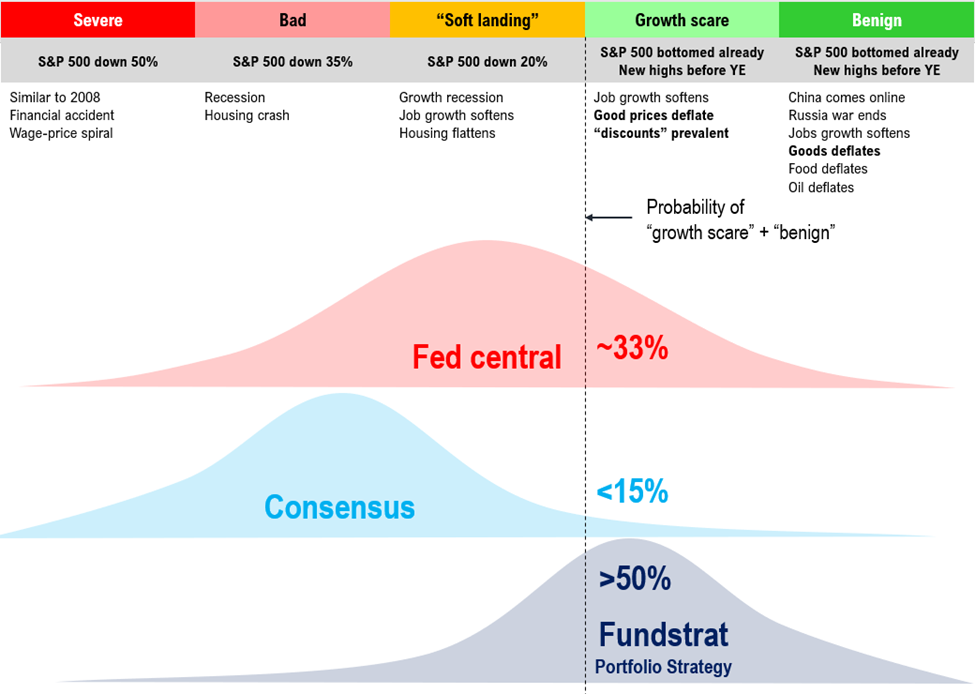

So, don’t ever fight the Fed but also understand what is behind the Fed’s behavior. The Fed does a delicate dance with market participants that includes signaling their path while also maintaining the credibility that is at the crux of their ability to successfully carry out their statutory duties. Currently, even though the Fed is tightening we believe that many episodic drivers of inflation are coming down and the types of inflation we are facing are not very effectively countered with monetary policy. So, if inflation ends up being much less problematic than folks think and it begins naturally alleviating, consensus very well may have overpriced a negative outcome for markets. However, based on our understanding of the inflationary drivers and our analysis of soft employment data, we believe that better outcomes of a “soft landing” are currently being underappreciated by markets.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World