Part 1

Financial Instruments! How to use them and what are they for!

“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

-Benjamin Graham, The Intelligent Investor

We are aware that we have many subscribers of varying skill levels and exposure to markets. We have received feedback that some subscribers would like educational materials to help bolster and crystallize our analysis, which comes directly from market experts to be complicated to newer audiences. One of the inevitable consequences of getting analysis directly from our Head of Research, Tom Lee, is that sometimes it will involve terminology and analysis that can be foreign to some.

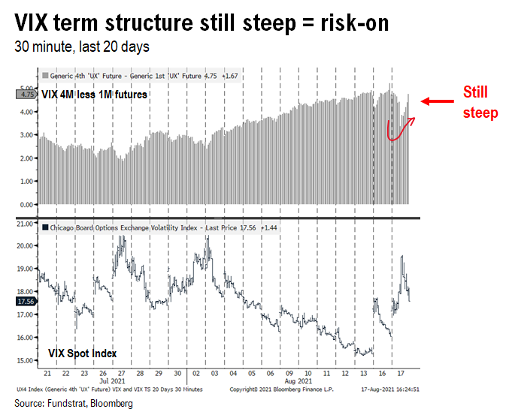

For example, Tom Lee will regularly cite the behavior of the CBOE Volatility Index, or VIX, as it is colloquially known. He periodically analyzes the term structure to decipher signals about where the market is going. Now is the VIX a complicated index? Yes, it absolutely is. This is why we prepared a complete guide to help you dive into precisely what it is and how it is calculated, which is available in our FSI Academy VIX Guide.

However, you don’t have to understand precisely how the VIX is calculated to understand the concept Tom is getting at. When the VIX term structure is inverted, what the market is saying is that there is a likelihood of more things going wrong in the next month than over the next four months or backwardation. More can happen over four months which is why this signal usually means panic has reached a local apex. The principle that more risks can happen over more time is one that most people fundamentally understand, but if you’re intimidated by the terminology, you may miss a valuable insight.

Investing today is quite different from investing hundreds of years ago; it is also a lot more similar to those days than you may initially think. Dozens of new asset types, revolutionary technologies, and the voracious risk appetite of younger generations have ensured that markets are constantly changing.

However, there are also several perennial dynamics in markets that will exist if fear and panic do. The myriad of different assets and the diverse needs of investors can quickly confuse and inundate those attempting to manage their own portfolios. We have created this educational guide based on feedback from our subscribers.

Our job at FSInsight is to help you navigate markets, and understanding the basics is necessary to do this. There are no dumb questions. Please don’t hesitate to let our team know what other subjects it would be helpful to produce educational content for. We design our guides to be entertaining, functional, and, most importantly, educational for all skill levels and investors who may read them. A refresher and new perspective NEVER hurt!

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!