Cosmos

$ATOM

13 Results

Arbitrum Backtracks on Governance Proposal and Bittrex winds down U.S. Operations

After a choppy weekend, BTC -1.54% and ETH -0.08% are flat on the day, down 0.68% and up 0.06%, respectively. SPX is down 0.02% at the time of writing, and NDQ is down 0.92%. Most altcoins have underperformed BTC and ETHâSOL -5.60% is down 1.32%, OP -1.27% is down 1.82%, and ATOM -5.14% is down 1.12%. Ethereum Layer 2, Arbitrum, was hit the hardest this weekend after the team backtracked on a governance proposal (which...

MOST SIGNIFICANT BANKING FAILURE SINCE THE GFC Our clients know the rationale behind our bullish perspective on crypto this year. Consumer prices are broadly trending lower, peak-tightening occurred last year (on a rate-of-change basis), and global liquidity conditions have been more favorable than many anticipated. We also felt comfortable that most of the “forced selling” from market participants exiting the ecosystem was behind us. Unfortunately, over the past few weeks,...

ANOTHER RINSE Last week, we talked about the futures market getting ahead of its skis, trading with increased leverage despite a continued lack of follow-through in spot market demand. Well, rates and the dollar have remained stubbornly high on the back of continued hawkish rhetoric from central bankers, and as we will discuss below, global liquidity has pulled back in recent weeks. Thus, bulls received another blow on Thursday evening...

BULLS OUT OVER THEIR SKIS IN THE SHORT TERM This was obviously a disappointing week for the bulls. We have yet to see the rollover in yields that we were anticipating in the near term, and as a result, crypto is starting to catch up with global equities. We can see below that an apparently overzealous derivatives market exacerbated the lack of follow-through in the spot market. Below we map...

REGULATORY THREATS MORE BARK THAN BITE (TO ASSET PRICES) Last week we discussed that more regulatory actions would be coming – and they certainly were. On Monday morning, Paxos was ordered to shut down its services surrounding Binance’s BUSD stablecoin on the grounds that it might be deemed a security. There were worries that there would be additional regulatory action against other centralized stablecoin issuers, but as the week progressed, it...

Equities declined Monday morning, likely prompted by caution over increased hawkishness from the Fed following the strong US jobs report on Friday. The SPX is down 0.4%, while the NDQ is trading 0.5% lower. Bond yields increased, with the 10-year yield rising by 9 BPS and the 2-year adding 14 BPS. The DXY (+0.5%) and the VIX 2.25% (+6.0%) have also ticked higher on the day. Meanwhile, the crypto market is...

Crypto and traditional markets consolidated ahead of today's FOMC meeting at 2 pm EST. The market is currently pricing in a 98.7% chance of a 25 bps rate hike according to CME Group's Fed Watch tool. BTC -1.54% and ETH -0.08% are down 0.57% and 0.70%, respectively, and SPX and NDQ are down 0.57% and 0.32%. Despite the broader market consolidating, certain altcoins have continued to rally. ATOM -5.14% is up 6.55% and...

BACK TO LIFE If you were 100% deployed on January 1st and decided to lock in your returns for the year, frankly, we wouldn’t blame you, especially not after the carnage witnessed last year. However, as we discussed last week, we view this current rally as a sign of more opportunities to come and are excited to help our clients navigate the crypto market in 2023. The choppy, directionless crypto...

Despite the US Dollar and US Treasury yields declining, US equity indices continue their slide this week, with the SPX and QQQ down 0.12% and 0.47%, respectively. Crypto markets are also negative today as BTC -1.54% (-1.56%) continues to trade in the upper 16,000s and ETH -0.08% (-3.27%) in the mid 1,200s. Alt layer-1 tokens are taking a larger hit today, with ATOM -5.14% , FTM -6.57% , and SOL -5.60% down -5.57%, -6.01%, and -4.69%, respectively....

FIGURE: PEPE FORMULATING DEFI METRICS Since DeFi’s summer ‘20 peak, the general crypto narrative has indisputably shifted away from DeFi, to Web 3.0 and gaming. Granted, the next billion users to crypto are more likely to onboard through gaming than the 69th fork of Uniswap. Yet, many still rely on core DeFi principles to innovate continuously. NFT projects are incorporating airdrops and collateralization of NFT assets, while Web 3.0 /...

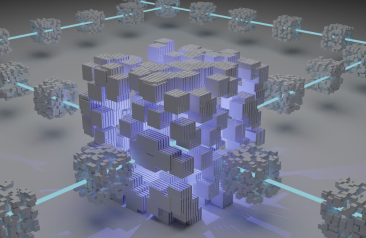

FIGURE: PEPE CROSSING BRIDGES TO EXPLORE ALTERNATE LAYER 1S / LAYER 2S Although ETH remains the dominant Layer 1 for most on-chain activity, alternate Layer 1s have demonstrated product-market fit throughout the bull market run of ‘20/’21. Solana (SOL -5.60% ) emerged as the ‘high-throughput chain’ focused on complex DeFi / gaming, BNB Chain (BNB 2.08% ) offers easy fiat on/off-ramps through Binance CEX, while Avalanche (AVAX -5.21% ) and Cosmos (ATOM -5.14% ) are building application-specific blockchains...