Tether

$USDT

18 Results

WHAT HAPPENS WHEN BONDS HAVE A HIGH EMISSIONS SCHEDULE Traditional markets have undeniably faced a whirlwind of volatility over the past week. The bond market continued its recent trajectory with the long end of the yield curve soaring to new multi-decade highs. At one juncture, the 30-year yield even brushed against the 5% mark, a development that has rattled both bond and equity investors. Concurrently, the DXY index maintained its...

FIGURE: PEPE LEARNING ABOUT GHO AFTER BEING RUGGED BY UST Source: Fundstrat INTRODUCTION Founded by Stani Kuchelov, Aave (formerly LEND) is the largest DeFi lending market by TVL (~$8b across v2 and v3) and the fifth largest dApp overall. The protocol is currently live across five networks and 11 markets, hosting more than 30 assets across its platform. In July ‘22, Aave announced that they are launching their native stablecoin,...

DOVISH FED STATEMENT On Wednesday, the Federal Reserve raised the target Fed Funds rate range by 25 basis points (BPS), marking the ninth increase in just over a year. The FOMC statement hinted at a nearing end to rate hikes by removing the reference to "ongoing increases." According to the FOMC's updated forecast, there will be one more rate increase this year, and officials expect slower economic growth in 2023...

MAPPING POSSIBLE CONTAGION Recently, we have discussed the risk of further drawdowns from the fallout from FTX as the reason for not being too aggressive at these admittedly favorable long-term entry levels. In this week’s note, we wanted to further unpack a few areas of the market where contagion could be lurking. Below is a fascinating graphic compiled by Bloomberg that maps SBF’s exposure throughout the crypto and traditional financial...

FIGURE: PEPE TRYING TO GET AN UNCOLLATERALIZED LOAN ZERO-TO-ONE (Z2O) SERIES Given the decentralization and transparency benefits of blockchains, many have pointed to DeFi as crypto’s ‘killer use case.’ After all, finance today is built along opaque and slower traditional finance rails ripe for disruption by distributed ledger technology. Sobering up from the highs of the bull market of ‘21, however, DeFi advocates are now left wondering: ‘How much of...

DESPITE MARKET PULLBACK, JACKSON HOLE WAS NOTHING OF SUBSTANCE Fed Chair Jerome Powell took to the microphone on Friday afternoon for the first time since he announced the Fed’s prior 75 bps rate increase. Powell has mastered the art of tactful political speech, as he used 10 minutes of words to say nothing of substance. While there was a small corner of the market that thought Powell would cavalierly announce...

NOT-SO-PRIVATE KEYS This week started with a pair of high-profile exploits – the first of which came in the form of a bridge hack, as interoperable bridging protocol Nomad was hacked for $200 million. Ironically, the vulnerability appeared to stem from a known bug highlighted in a previous audit. Despite this, the Nomad hack furthered widespread skepticism surrounding multichain bridge security. To seemingly one-up Monday’s hacker, an entity on Tuesday...

FIGURE: GHO LAUNCHING AMIDST THE BLOWUPS AROUND IT Seeing the CeFi realm blowing up around us, it is perhaps pertinent to reflect and hammer the lessons into our collective crypto consciousness. Drawing from CeFi, DeFi and Everything in Between, it is clear now that Celsius, BlockFi, and Voyager Digital function as ‘CeDeFi,’ similarly to TradFi banking entities and are prone to the same weaknesses such as position opacity and human...

UPDATE ON THE MERGE Despite one of our potential catalysts for the year being struck down this week (the GBTC conversion to spot ETF), the prospects for a 2022 Ethereum remain intact. This weekend, ETH developers will attempt the second of three testnet merges on the path to mainnet Merge. Testnet merges are essentially dress rehearsals for the main event – the Merge of the Ethereum mainnet. The first testnet...

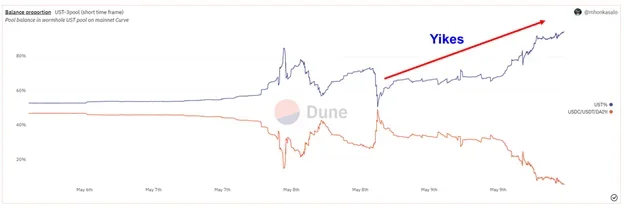

THE MAKINGS OF A QUASI-BANK RUN As if investors needed more reasons to be bearish, the market was thrown into a slight bout of chaos on Monday after a quasi-bank run on UST. Please refer to our prior work on the topic for further background information on UST’s functionality, Luna Foundation Guard, Anchor, and stablecoins. FIRST PEG-BREAK We have ample reason to believe that the “run” on UST was not...