Brian's Dunks

Stock List

Brian's Dunks

Stock List

This section of FS Insight has been deprecated and is now part of the archive. It is no longer actively maintained or updated. For more information contact us.

Introducing Brian's Dunks

If something is a ‘sure-thing’ someone might refer to it as a slam dunk. We like applying sports metaphors to investing, like our ‘Granny Shots’ product. While there is no such thing as ‘sure things’ investing there are now dunks. We wanted to give you a stock list of the best stocks, or ‘dunks’, derived from our Head of Global Portfolio Strategy Brian Rauscher’s advanced and proven stock-picking methodology. It might seem impossible to ‘dunk like a pro’ when it comes to investing. Maybe you feel like you're always chasing the end of the trend, a day late and a dollar short, so to speak.

However, when you have access to insights derived from the same models and tools that banks and hedge funds use ‘to play ball’ you may find yourself feeling quite a bit taller.

At FS Insight, an important objective of ours is to deliver our clients high quality and actionable ideas starting at the index level, then moving to sector allocations, and finally all the way down to the single stock level. We have received a lot of requests for a consolidated ‘best of best’ stock list and we think Brian’s quantitative methodology is a perfect selection tool to give investors an edge. Our goal is to produce differentiated products that are normally only available to institutional level accounts and provide expanded access to individual investors and RIA’s. With these goals in mind, we are excited to launch our new single stock idea product called Brian’s Dunks.

Simply, there will be five stocks highlighted on Brian’s monthly Dunk list, which ultimately will be our best of the best. Brian will also select 5 mid-range jumpers, stocks that have great potential for upside but may carry more volatility because of their market cap and other characteristics. At the highest level, these ten names will be selected using time-tested proprietary quantitative models usually only available to institutional clients. The basic concept of “Brian's Dunks” is to identify specific stocks that are likely to outperform the broad market without taking on a considerable amount of additional risk.

Every month, Brian will provide a new list of dunks and mid-range jumpers to keep bringing TIMELY AND ACTIONABLE ideas to all our subscribers. Stocks will be categorized as:

- PLAY ( consider increasing exposure )

- HOLD ( consider keeping and not adding exposure )

- OUT ( consider removing exposure )

The selections are based on his emotionless system to signal investors how to manage the Dunks.

Meet your Coach!

Brian has an established expertise in the type of process-based, quantitative research that is data-driven and divorced from emotion. This approach to investing is one of the major reasons why institutional investors usually do a better job of avoiding many of the mistakes common to retail investors. Brian’s research does not evaluate stocks on a subjective bottom-up, fundamental basis. Quite the contrary, his disciplined objective investment and selection process is dominated by various quantitative and qualitative metrics that when combined have had a demonstrable and compelling track record of picking winners.

It is this data driven style towards research and idea selection that is consistent throughout all the FSI products and highly valued by our long list of institutional clients from around the globe. We are able to use our time-tested proprietary process to see through the ‘fog of the present’ that causes so many investors to make rash decisions that hurt their returns. We look at every security through many lenses to arrive at clearer picture than most. We want to help you ‘dunk’ like a pro. Shattered glass. The whole nine yards.

Brian Rauscher

Head of Global Portfolio Strategy & Asset Allocation

Introducing "Brian’s Dunks" and "Mid-Range Jumpers"

Brian will mainly be making his selections from the S&P 500 and the S&P 400 Midcap indexes. Each of the stocks in this universe are categorized by the Global Industry Classification System (GICS). Which is a four-tiered, hierarchical industry classification system—Sector (GICS L-1), Industry Group (GICS-L2), Industry (GICS L-3), and Sub-industry (GICS L-4). Essentially, companies are classified both quantitatively and qualitatively according to principal business activity. MSCI and S&P Dow Jones Indices use revenues as a key factor in determining a firm’s principal business activity, as well as earnings, market perception and other relevant information are also used in the classification designation.

So, What EXACTLY Makes A Stock A Dunk?

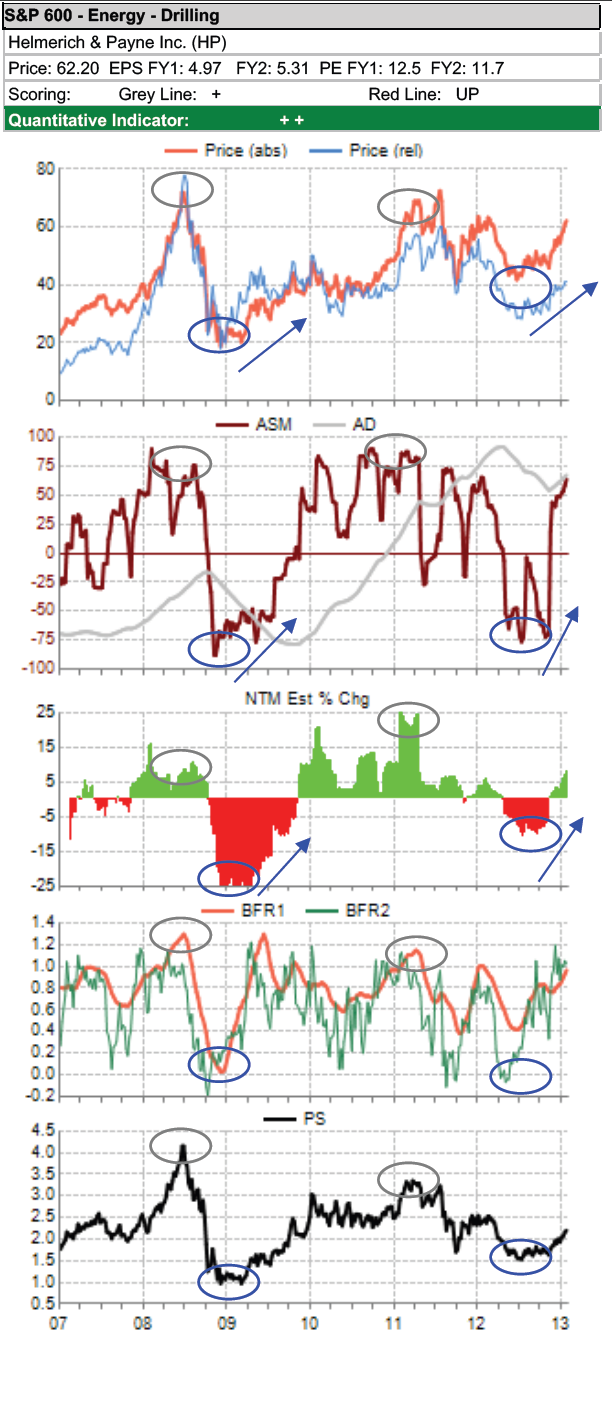

Brian’s research over the past two decades has enabled him to develop a unique proprietary system that has proven efficacy in highlighting the attractiveness of single-stock names within a larger universe, which is called the Earnings Revision Model (ERM). Importantly, this powerful model is our main tool for taking investment ideas down to the single-stock level.

We evaluate the attractiveness of single stocks by analyzing three main factors. Please note that the model has both contrarian and momentum characteristics.

- Earnings Estimate Revisions

- Price Momentum

- Valuation

In addition, any stock that qualifies as a DUNK often presents the following characteristics:

- Improving forward earnings prospects as captured by the aggregations of the analyst community for that stock. The model’s most important inputs are two different concepts of estimate revisions.

- Our primary indicator is based on the second derivative of the breadth of analyst estimate changes and is, based on our research, a leading indicator in future price performance.

- A second and complimentary earnings revisions metric that measures the magnitude of the change in the forward twelve-month EPS estimate is favorable.

- Positive but not extreme price momentum as shown by his indicators.

- Valuation that is not extreme.

What is the difference between Dunks and Mid-Range Jumpers?

Similar to an all-star game, where all the players on each team are good and stand out versus the others in the entire league, there are only so many spots on the starting team. Our Dunks list will be the names that come out of our proprietary single stock quantitative model and offer investors a favorable reward/risk outlook based on our research.

Mid-Range Jumpers will generally be higher beta names. This means they generally have more significant price movement than the index in either direction. Typically, this list will contain more mid-cap and small-cap stocks that contain more risk than companies with larger market-caps and more liquid markets for their securities. In certain market conditions, these stocks may actually provide more upside than Dunks in some cases. Still, they nonetheless are kept in the Mid-Range Jumper Section because of the higher beta nature of these stocks, which can translate into more risk for your portfolio. Dunks have a more attractive reward/risk ratio than Mid-Range Jumpers. However, as we’ve noted, if you have lower risk aversion, then Mid-Range Jumpers will likely contain great opportunities for significant price appreciation.

Importantly, if an investor has a higher risk tolerance and takes more active risk, the mid-range jumpers are also expected to post market-beating performance and could add diversification benefits as well. Thus, owning both Dunks and Jumpers as a ten-stock basket is designed to provide good reward/risk performance over time.

Why Use Estimate Revisions For Stock Selection?

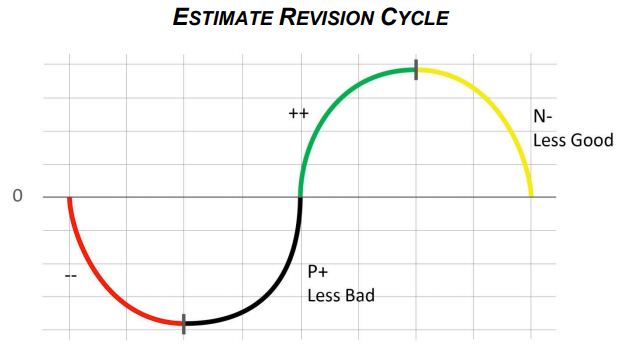

Our research shows at the sector, sub-sector, sub-industry and single-stock level, an inflection point from an extreme reading in our proprietary estimate revision indicators—a second derivative change shifting from red (double minus) to black (P+) — is an important leading-performance indicator, especially when it occurs in conjunction with both an oversold reading and an attractive valuation level.

Furthermore, the subsequent improvement of our proprietary metrics has provided valuable signals to which stocks will likely continue their outperformance run when they shift from black (P+) to green (double plus).

Estimate revisions improving on an absolute basis signaling that the bottom-up consensus is now actively raising forward expectations.

Stock price is generally acting well and is becoming a momentum play.

Estimate revisions have experienced a positive inflection (second derivative turn) though absolute activity remains negative.

Probablity is rising that the stock price may be nearing a bottom which leads to a high quality entry point.

Estimate revisions have experienced a negative inflection (second derivative turn) though absolute activity remains positive.

Probablity is rising that the stock price may be topping which leads to a high quality trim/exit point.

Estimate revisions deteriorating on an absolute basis signaling that the bottom-up consensus is now actively lowering forward expectations.

Stock price is generally acting poorly and still too early to get aggressively long.

How Should ‘Dunks’ and ‘The Mid-Range Jumpers' Be Used?

Essentially, each month Brian will be providing a list of ten stocks that his research methodology highlights as exciting opportunities. Some of these stocks will be PLAY stocks, which means they are actionable right at the publication day. This ongoing stock list should not be thought of as a stand-alone portfolio. These are simply stocks that we want to highlight for our subscribers, that based on our methodology, are likely to outperform the wider market without considerably raising one’s risk exposure.

Intra month changes can occur at any time and are based on Brian's discretion and interpretation of his model. Any changes that occur intra month will be communicated. Such changes can happen when “better” opportunities are signaled, or some “Dunks” fail to pass the above highlighted criteria.

As the different months develop, stocks might switch from PLAY to HOLD. This tells investors do keep their current position and do not add extra exposure to the stock. Similarly, as time goes by, the stock may start to present negative readings from Brian's ERM system. At this point, the stock could be downgraded from PLAY or HOLD to OUT. This tells investors to remove or reduce exposure to the stock.

An investor always has to consider their own goals/objectives, risk tolerances, existing single stock holdings, and overall asset allocation when introducing a new name into their portfolio. With that being said, each name should be thought of both on its single stock merit as well as being part of a diversified portfolio.

A stock being designated a ‘Dunk’ should be interpreted as being a good opportunity and should be considered for inclusion into one’s portfolio. As a reminder, our methodology and selection process are more objective, and model based than traditional bottom-up equity strategies. While we may offer some tangential fundamental analysis and expand on specific stocks, the primary thrust of our selection method is model-driven. Therefore, we would advise investors to do some due diligence to make sure a recommendation is consistent with your respective reward/risk preferences.

It should be noted that the deletion of a stock from the ‘Dunk’ basket is not necessarily an outright sell signal. A stock could be removed from the ‘Dunk’ list for several reasons including that other names may have shown better potential going forward, expectations of a market rotation into another area, or it may be tactically extended. We will regularly communicate our thought-process for removing and adding stocks. Please, also always feel free to submit your questions to us at inquiry@fsinsight.com.