Part 1

Why Inflation Matters

For the better part of the past two years (2022-2023), market strategists, investors, and policymakers – to say nothing of everyday consumers – have been talking about inflation. For consumers, the primary concern has been a reduction in their purchasing power, particularly when it comes to household expenses such as food, gasoline, and/or rent.

For investors and market strategists, the inflation rate has been important because of how policymakers’ responses to high inflation can affect corporate earnings, interest rates, and thus, stock prices. A quick search for the word “inflation” on the FS Insight website shows that it appears in the vast majority of notes that we have published during this period.

Part of understanding the analyses provided by FS Insight requires an understanding of what inflation is, and why it matters. So what is inflation, exactly?

Inflation is the rate at which the price of goods and services rises over a sustained period of time. Importantly, inflation is what occurs when prices rise across many types of goods and services – not just one, and only when those prices rise over a sustained period of time (rather than a one-time increase.) So if the price of gas rises after a hurricane destroys refining facilities but settles shortly afterward as the supply chain adjusts, this would not be inflation, as price increases were seen only in one class of goods, and only for a limited time.

Why do policymakers care about inflation?

Inflation influences the spending, savings, and investment decisions of consumers and businesses in many ways. At more extreme levels (both high and low), these aggregate changes to consumer and business decisions can affect a country’s economic growth and social stability.

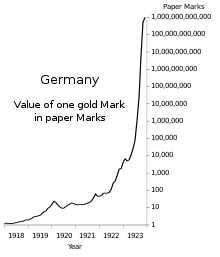

Perhaps the most famous example of the detrimental effects of extremely high inflation is the Weimar Republic – Germany between late 1918 and early 1933. The hyperinflation – with nominal prices roughly doubling every three days – caused such economic distress and popular unrest in post-World War I Germany that many historians believe it played a significant role in the rise to power of Adolf Hitler and the Nazi party.

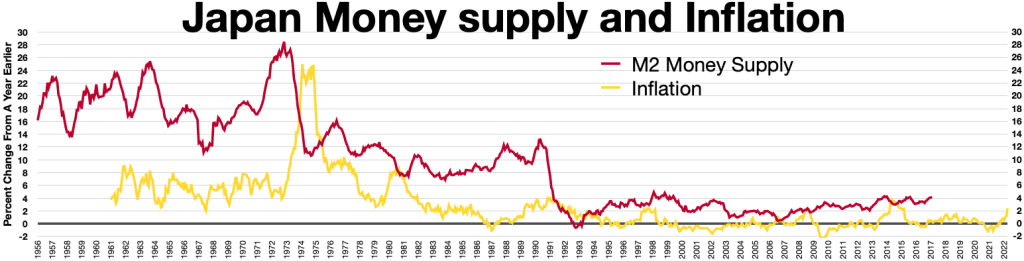

On the other side of the coin, deflation (extremely low inflation, including negative inflation), is widely seen as a major reason that Japan’s economy began to stagnate in 1990 and continued to do so for several decades afterwards. The country continues to struggle with the societal effects of what are popularly known as its “Lost Decades,” including an alarmingly low birth rate partially caused by an entire generation of Japanese opting not to have children due to limited resources.

At less extreme levels, high inflation is viewed as detrimental because it reduces purchasing power, causing instability through uncertainty and by exacerbating the effects of wealth inequality. It also makes it more difficult (and unlikely) for consumers and businesses to make sound long-term financial decisions.

Unsuitably low rates of inflation can make it difficult for households and businesses to service their debt. It can also reduce employment and disincentivize business capital expansion and investment, thus impeding long-term growth.

Is all inflation bad?

While overly high inflation and overly low inflation can each cause damage to a country’s economy, a moderate level of inflation is generally seen as a good thing. There is no hard and fast rule as to what that level is, but many economists – including those at the U.S. Federal Reserve – assert that the optimal level for inflation is somewhere around 2-3%. Deviating slightly from this range might not result in any noticeable consequences, but the larger and more sustained the deviation, the more likely it is that consumers, businesses, and the economy will notice an impact.

An appropriate and relatively stable level of inflation can encourage the proper levels of spending, saving, and investment – both by companies and businesses. These, in turn, fuel economic growth, corporate profits, employment, and living standards.

In future discussions, FSI Academy will cover how to measure inflation, what causes it, and what can be done to keep it under control.