Part 1

The Importance of Risk Management Is Hard to Overstate

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.” — Peter Lynch

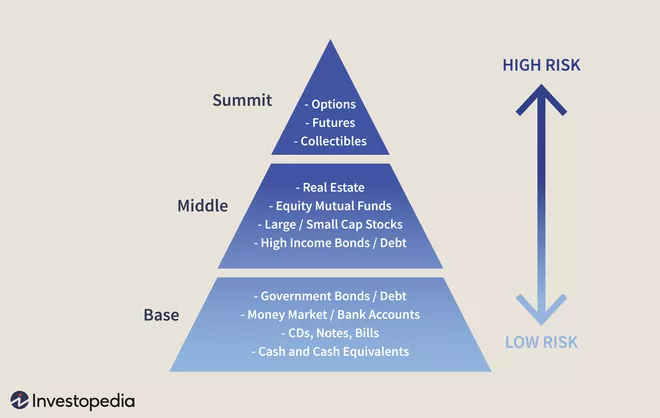

Investing involves dealing with the future. The challenge? The future is inherently uncertain. Thus, risk is inescapable. Investors must confront it. While many investors shy away from risk, it’s what makes the whole game of investing interesting. A job with challenge makes things engaging. A job without challenge is boring. For challenge to be present, there must be risk — the nature of making decisions and what makes it all so fascinating.

Here’s a simple story about risk. Let’s say you make an investment you consider risky. Maybe you buy a stock at $100 today and sell it next year at $200. Was it risky? It depends. Maybe the investment was exposed to many risks that didn’t materialize. Or maybe you bought another stock at $100, and it fell to $50 when you sold, marking a 50% loss. Does that mean it was riskier than the other investment? Not necessarily. The fact that something happened doesn’t mean it was bound to happen. Probable things fail to happen – and improbable things happen – all the time.

Just ask actor Matt Damon, who once said something along these lines when asked, what was the most surprised he had been with a movie that didn’t work out? He thought about it for a few seconds, then said it would be impossible to pick one. The reception is almost always not what he expects. “They’re all bets to a certain degree,” Damon said. “I always tell people, ‘You don’t see the movie before you make it.’ You get the ingredients for whatever you’re cooking, you get to see what ingredients you have to work with, and then you, ‘alright, with all these ingredients, we should be able to make something pretty good.’ But some of them just don’t work.”

The principle applies to investing in a profound way. You can have all the ingredients to make a sound decision – information, software, knowledge, research – and still make a mistake or sustain a sizeable loss. As Damon said: Some things just don’t work out. Many futures are possible. A portfolio can be set up to withstand 99% of all probabilities but succumb because it’s the remaining 1% that materializes.

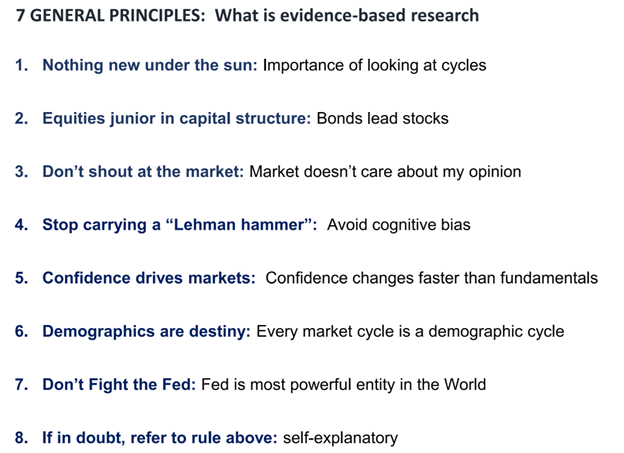

In short, return alone says little about the quality of investment decisions. Risk, defined as the possibility of financial loss, is integral to understanding the quality of a decision. The issue? Risk is immeasurable, which makes it hard to recognize, especially when emotions are running high. It’s truly only seen in retrospect.

In bullish times, human psychology leads many investors to overestimate their ability to clearly see risks. The received wisdom is that risk increases in the recessions and falls in booms. In contrast, it may be more helpful to think of risk as increasing during upswings, as financial imbalances build up, and materializing in recessions, noted Andrew Crockett, a British banker and economist. Mostly because of investor psychology, markets generally swing toward or back from one extreme or the other, and Howard Marks has said that participating when prices are high rather than shying away is the main source of risk.

Ebb and flow of a bull market:

- A few prudent people begin to believe things will get better

- Many investors realize improvement is taking place

- Everyone concludes things will be great for a long time, taking on more risk when they probably should be reducing it

Ebb and flow of a bear market

- A few thoughtful investors realize things won’t be this rosy for much longer

- Many other investors realize things are deteriorating

Everyone’s convinced things can only get worse, taking on less risk when they probably should be taking on more

Dealing with risk starts with recognizing it, and human nature is timeless, so there’s plenty to learn from. The dot-com bubble emerged when a belief that risk had vanished. In 2005-2007, a similar thing occurred. And then in 2021, many investors got caught up in the idea that risk was low. They made big bets on stocks that turned out to be at their peaks. Many of them dropped sharply in the first half of 2022, and some gave back all their pandemic-era gains in a few months.

Investors such as Buffett, Marks, Charlie Munger, Stanley Druckenmiller, Bill Miller, Julian Robertson, and others are so good because they’ve not only produced consistently high returns, but they’ve avoided catastrophe. Sure, they’ve had relatively bad years, but no bad year or trade or month did them in. Risk management is a main reason why.

Said Buffett: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”